20 May 2005 _____ ii DIRECTOR GENERALS PUBLIC RULING A Public Ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

. 112019 Translation from the original Bahasa. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. Pages 17 of 31 BENEFITS IN KIND.

B Second Addendum to Public Ruling No. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

C Third Addendum to Public Ruling No12004 dated 17 April 2009. View PR_11_2019 - BENEFITS IN KINDpdf from TAX 2033 at Tunku Abdul Rahman University. The objective of this Public Ruling PR is to explain -.

Its important to understand the various benefits-in-kind as well as perquisites and. 15 March 2013 Pages 1 of 31 1. Objective The objective of this Ruling is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and.

The tax treatment in relation to benefits-in-kind BIK received by an employee from his employer for exercising an employment. 8211 Modern medicine traditional medicine and maternity. 112019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. 15 March 2013 c Only benefits received by an employee from his employer either in the form of consumable business products or services is exempted from tax. These benefits are called benefits in kind BIK.

And one should also be aware of exemptions granted in certain. Public Ruling No32013 Benefits In Kind This Ruling has been published to merge Public Ruling No22004 issued on 8 November 2004 with a Addendum to Public Ruling No12004 dated 20 May 2005. 12 December 2019 Page 2 of 27 b Where the relationship does not subsist the person who pays or is responsible for paying any remuneration to the employee who has the employment notwithstanding that the person and the employee may be the same person.

22004 dated 17 January 2006. Page 18 of 27 BENEFITS IN KIND. 42 The value of this benefit is taxable specifically under paragraph 131c of the ITA.

Paragraph 234 of the Third Addendum to Public Ruling No. These benefits-in-kind are mentioned in paragraphs 43 and 44 of the Public Ruling No. 11 Date of Publication.

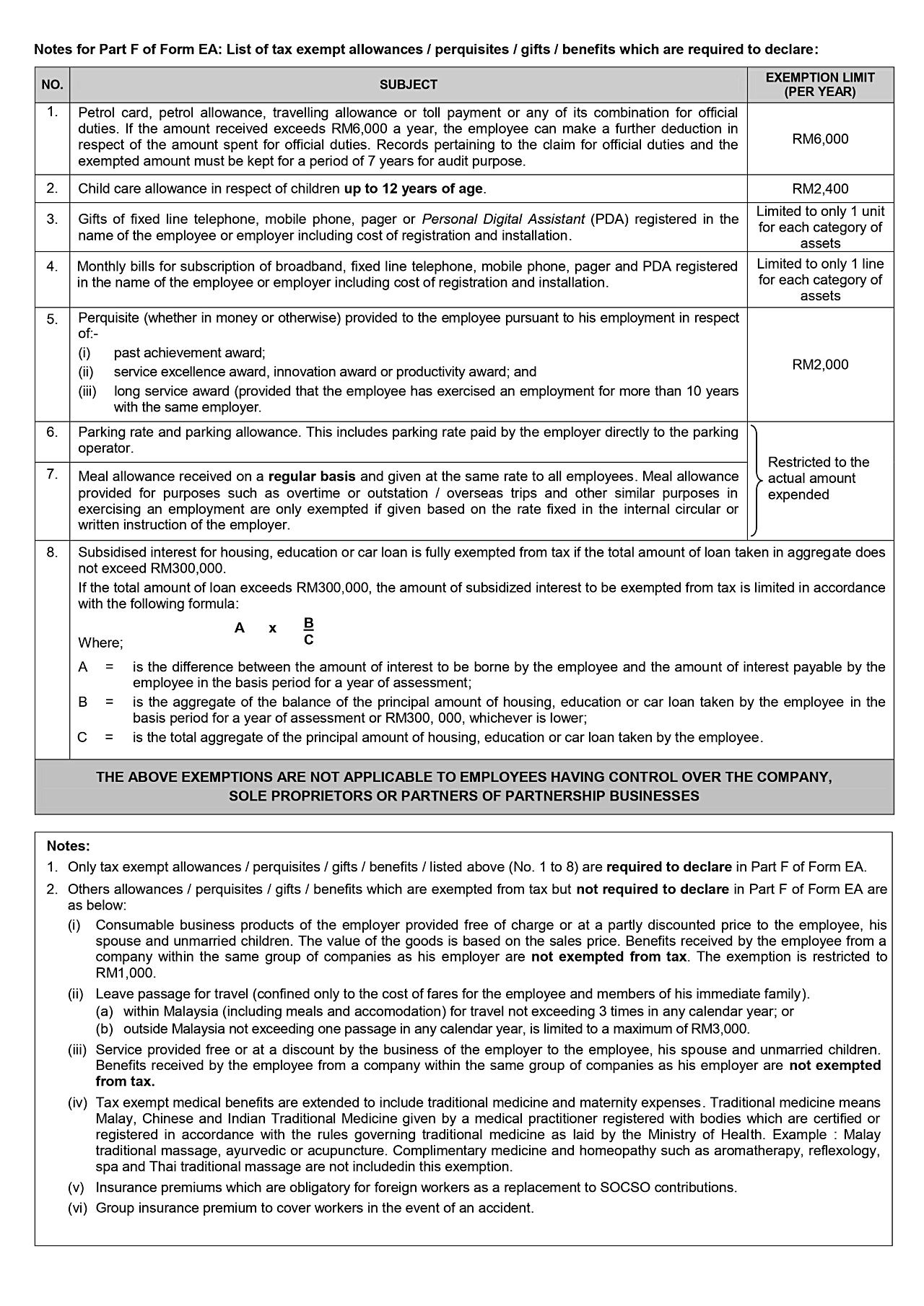

In relation to that the taxpayers are entitled for tax exemption for the following. 22004 issued on 17 January 2006. A further clarification on benefits-in-kind in the form of goods and services offered at discounted prices is explained in the Second Addendum to the Public Ruling No.

INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND PUBLIC RULING NO. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. 32013 Date of Issue.

A Ruling may be withdrawn either wholly or in part by. A Discounted price for products or services purchased from employer b Monthly telephone or broadband services provided by employer. 28 Feb 2009 Public Ruling No.

The amount to be taken into account in the gross income from. BENEFITS IN KIND Public Ruling No. 8 November 2004 INLAND REVENUE BOARD MALAYSIA _____ b.

A The medical treatment benefit exempted from tax is in respect of modern medicine traditional medicine and maternity. Any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. 112019 Date of Publication.

32013 INLAND REVENUE BOARD OF MALAYSIA Date of Issue. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. 22004 BENEFITS-IN-KIND LEMBAGA HASIL DALAM NEGERI MALAYSIA Date of Issue.

22004 issued on 17 April 2009 is substituted with paragraph below. On 17 April 2009 The Inland Revenue Board IRB has released the 3r d Addendum Public Ruling on Benefits In Kind. A The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and.

Generally non-cash benefits eg. It sets out the interpretation of the Director General. BENEFITS-IN-KIND Public Ruling No.

It sets out the interpretation of the Director General of Inland Revenue. There are several tax rules governing how these benefits are valued and reported for tax purposes. 310 Perquisites means benefits that are convertible into money received by an employee from.

37 Perquisite in relation to an employment means benefits in cash or in kind that are convertible into money received by an employee from the employer or third parties in. Have moneys worth and is a benefit in kind that is convertible into money and b Are received from the employer in respect of having or exercising the. It sets out the interpretation of the.

22004 issued on 8 November 2004. BENEFITS-IN-KIND FOURTH ADDENDUM TO PUBLIC RULING NO. This Addendum provides clarification in relation to tax exemption on benefit on free petrol received by an employee pursuant to his employment.

22004 Date of Issue. Benefit-in-kind which is not convertible into money. This benefit which arises in respect of having or exercising an employment is to be included as gross income of the employee from the employment.

In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income.

Law Is Alberta Ending Coronavirus Restrictions Because Of Failing To Provide Evidence Of Sars Cov2 Virus Existence In Court Skeptics Stack Exchange

Canadian Tax News And Covid 19 Updates Archive

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

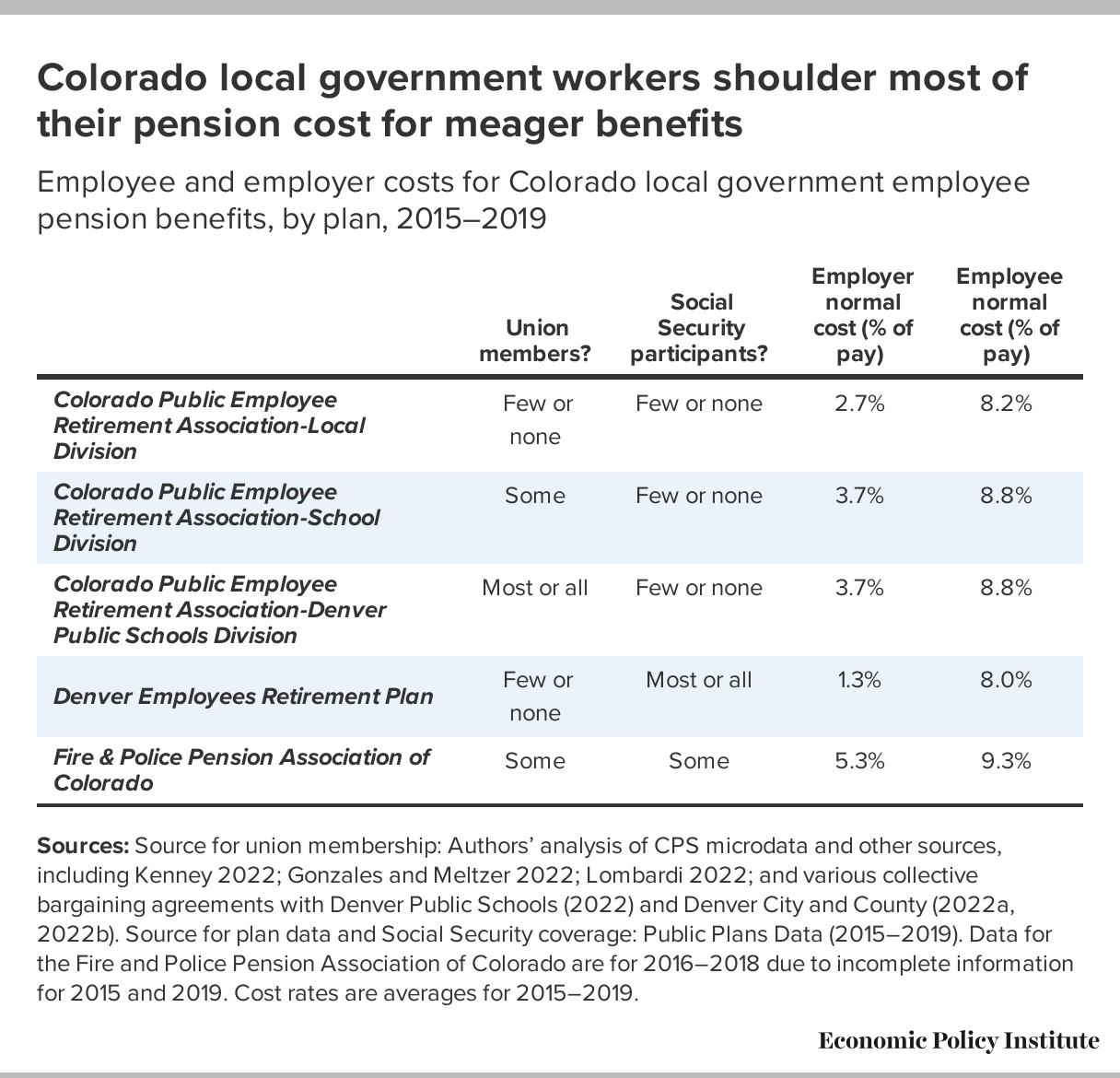

Unions Can Reduce The Public Sector Pay Gap Collective Bargaining Rights And Local Government Workers Economic Policy Institute

Public St Partners Plt Chartered Accountants Malaysia Facebook

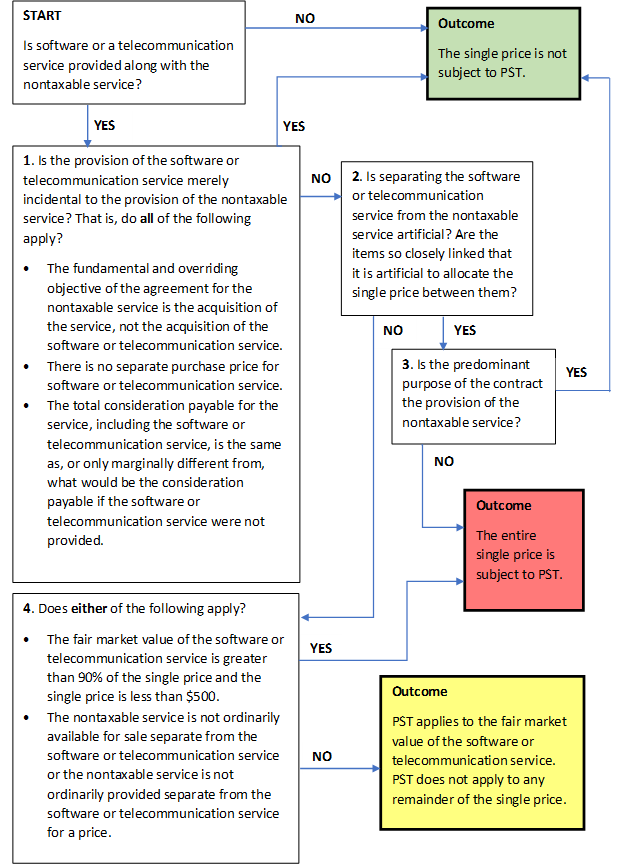

Tax Interpretation Manual Provincial Sales Tax Act General Rulings Province Of British Columbia

Canadian Tax News And Covid 19 Updates Archive

Houston Government May Be Backing Away From Promise To Repeal Bill 148 Cbc News

Vaccine Preventable Disease Surveillance Report To December 31 2017 Canada Ca

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers